IRS 8606 2024-2025 free printable template

Show details

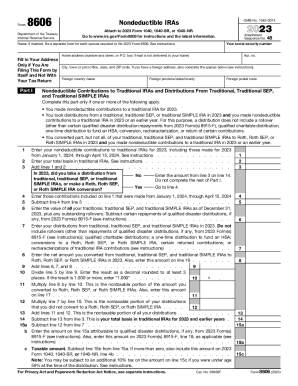

For Privacy Act and Paperwork Reduction Act Notice see separate instructions. Cat. No. 63966F 15a 15b 15c Form 8606 2024 Page 2 2024 Conversions From Traditional Traditional SEP or Traditional SIMPLE IRAs to Roth Roth SEP or Roth SEP or Roth SIMPLE IRA in 2024. If married file a separate form for each spouse required to file 2024 Form 8606. See instructions. Fill in Your Address Only if You Are Filing This Form by Itself and Not With Your Tax Return Attach to 2024 Form 1040 1040-SR or...

pdfFiller is not affiliated with IRS

Understanding IRS 8606: A Comprehensive Guide

Step-by-Step Instructions for Editing IRS 8606

How to Complete IRS Form 8606

Understanding IRS 8606: A Comprehensive Guide

The IRS Form 8606 is crucial for taxpayers dealing with nondeductible contributions to traditional IRAs or distributions from Roth IRAs. By accurately completing this form, you can ensure compliance with tax laws and avoid unnecessary penalties. This guide will provide you with detailed insights into using IRS 8606 effectively.

Step-by-Step Instructions for Editing IRS 8606

Editing IRS 8606 accurately is essential to reflect your financial activities correctly. Follow these steps:

01

Review your previous year’s form if applicable to ensure continuity and accuracy for ongoing contributions or distributions.

02

Gather relevant financial documents, including 1099 forms that show distributions from retirement accounts and records of contributions made to IRAs.

03

Verify the types and amounts of contributions—both deductible and nondeductible—made throughout the year.

04

Check your modified adjusted gross income to determine eligibility for deductions if any.

05

Input accurate figures into the necessary sections of Form 8606, paying special attention to distinguish between Roth and Traditional IRAs.

06

Consult online resources or tax software for guidance on any sections that may be unclear.

How to Complete IRS Form 8606

Filling out IRS Form 8606 requires careful attention to detail. Here’s how to complete it:

01

Start with your personal information, ensuring your name and Social Security number are correct.

02

Report each contribution you made to traditional IRAs in Part I, Item 1, specifying amounts you’ve already reported on prior filled forms.

03

In Part II, report any distributions from IRAs, calculating whether to include any amounts in your taxable income.

04

Complete Part III if you converted a traditional IRA to a Roth IRA; include all conversion amounts.

05

Sign and date the form, confirming its accuracy.

Show more

Show less

Recent Developments Concerning IRS Form 8606

Recent Developments Concerning IRS Form 8606

This year, the IRS has made significant updates to Form 8606, primarily concerning the thresholds for eligibility and reporting requirements. For example, the income phase-out range for Roth IRA contributions has been adjusted, potentially allowing more taxpayers to contribute. Stay informed about these changes to ensure your filings align with current regulations.

Essential Insights into IRS 8606

What is IRS Form 8606?

The Purpose of IRS Form 8606

Who is Required to File IRS Form 8606?

Conditions for Exemptions from Filing IRS Form 8606

Key Components of IRS Form 8606

Filing Deadline for IRS Form 8606

Comparison of IRS Form 8606 with Similar Forms

Transactions Covered by IRS Form 8606

Required Copies for Submission of IRS Form 8606

Penalties for Failing to Submit IRS Form 8606

Information Necessary for Completing IRS Form 8606

Accompanying Forms for IRS Form 8606

Where to Submit IRS Form 8606

Essential Insights into IRS 8606

What is IRS Form 8606?

IRS Form 8606 is a tax form used by individuals to report nondeductible contributions to Traditional IRAs, distributions from IRAs, and conversions from Traditional IRAs to Roth IRAs. It serves to track these contributions, which are not reported through your employer or other tax forms.

The Purpose of IRS Form 8606

The primary purpose of IRS Form 8606 is to prevent double taxation on nondeductible contributions. By documenting these contributions, they can be excluded from taxable income when withdrawn in retirement. Moreover, the form helps provide necessary data to the IRS regarding your IRA activity.

Who is Required to File IRS Form 8606?

Taxpayers must file Form 8606 under several scenarios:

01

If you made nondeductible contributions to a Traditional IRA.

02

If you received distributions from your Traditional IRAs.

03

If you converted a Traditional IRA to a Roth IRA.

Conditions for Exemptions from Filing IRS Form 8606

Some individuals may qualify for exemptions from filing IRS Form 8606 based on the following conditions:

01

Individuals with only deductible Traditional IRA contributions.

02

Taxpayers who only have Roth IRA contributions without distributions or conversions.

03

Those who have not made any nondeductible contributions to their IRAs.

Key Components of IRS Form 8606

IRS Form 8606 consists of several parts:

01

Part I: Nondeductible Contributions to Traditional IRAs

02

Part II: Traditional IRA Distributions

03

Part III: Conversions from Traditional to Roth IRAs

Filing Deadline for IRS Form 8606

The deadline for submitting IRS Form 8606 aligns with the overall tax return deadline. For the 2023 tax year, this is generally April 15, unless an extension is filed. Keep in mind that timely filing can prevent penalties and complications.

Comparison of IRS Form 8606 with Similar Forms

IRS Form 8606 is often compared with other forms related to retirement accounts, such as:

01

IRS Form 5498: Used by trustees/custodians to report contributions to IRAs.

02

IRS Form 990: Nonprofit organizations might use this for disclosures regarding investment income.

Transactions Covered by IRS Form 8606

Transactions reported on IRS Form 8606 include:

01

Nondeductible contributions to Traditional IRAs.

02

Distributions from Traditional IRAs where nondeductible contributions have been made.

03

Conversions from Traditional IRAs to Roth IRAs.

Required Copies for Submission of IRS Form 8606

Taxpayers are advised to file one copy of IRS Form 8606 with their federal return and keep additional copies for their records. Generally, no extra copies are needed for the IRS or state tax agencies unless specified otherwise.

Penalties for Failing to Submit IRS Form 8606

Failure to submit IRS Form 8606 can result in various penalties:

01

Failure to File Penalty: Generally amounts to $50 for each failure to file.

02

Accuracy-related penalties: May incur 20% of any underpayment attributed to negligence.

03

Tax liabilities: Unreported distributions and nondeductible amounts can lead to further tax dues and penalties exponentially when unregistered.

Information Necessary for Completing IRS Form 8606

To fill out Form 8606 accurately, you will need:

01

Your total nondeductible contributions made to IRAs.

02

The total amount you have distributed from your IRA accounts during the tax year.

03

Details of any conversions performed from Traditional to Roth IRAs.

Accompanying Forms for IRS Form 8606

While IRS Form 8606 can be filed independently, you may need to accompany it with:

01

IRS Form 1040 for individual income tax returns.

02

IRS Form 5329 if you owe additional taxes on early distributions.

Where to Submit IRS Form 8606

Submit IRS Form 8606 along with your federal tax return to the appropriate IRS address based on your state of residence. Ensure you check the current IRS guidelines for any updates regarding submission addresses.

Understanding and accurately completing IRS Form 8606 is essential for all taxpayers engaging with IRAs. Whether managing nondeductible contributions or navigating Roth conversions, ensuring accurate filings will help you maintain compliance and optimize your tax situation. If you have further questions or need assistance with your tax preparation, consider reaching out to a tax professional or utilizing online resources for support.

Show more

Show less

Try Risk Free