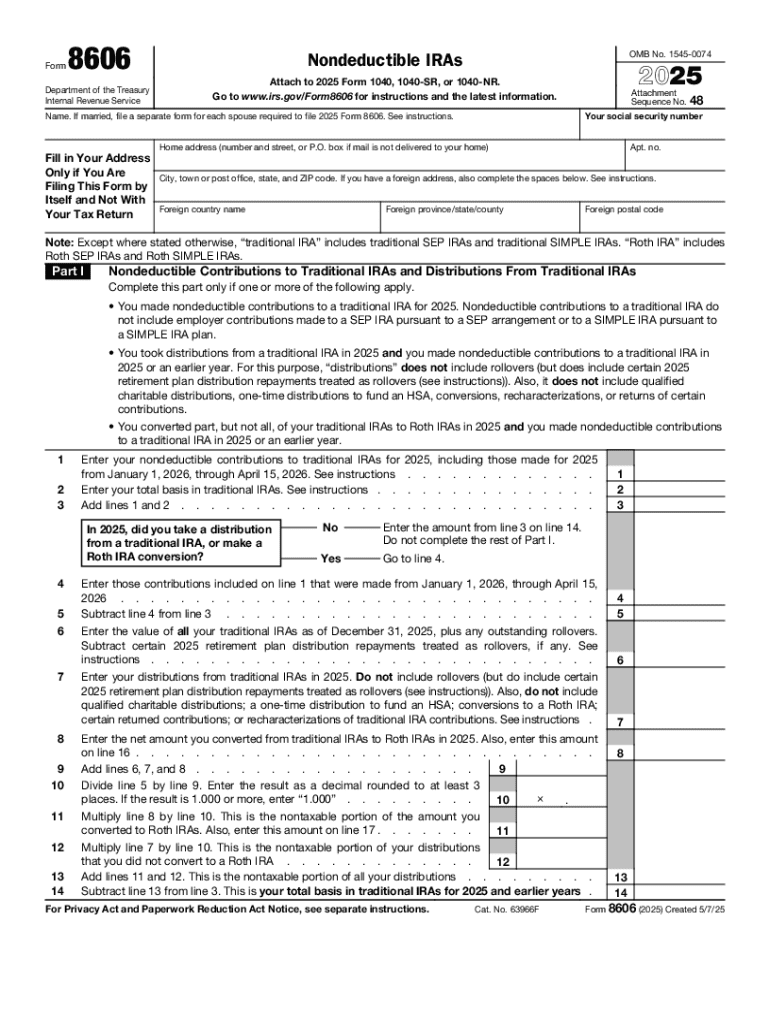

IRS 8606 2025-2026 free printable template

Instructions and Help about IRS 8606

How to edit IRS 8606

How to fill out IRS 8606

Latest updates to IRS 8606

All You Need to Know About IRS 8606

What is IRS 8606?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8606

What should I do if I realize I've made a mistake on my IRS 8606 after submission?

If you discover an error on your IRS 8606 after it has been filed, you'll need to submit a corrected form. This involves filing Form 1040-X to amend your original return and provide the corrected IRS 8606. Ensure that you indicate the changes clearly and provide necessary documentation to support your corrections.

How can I verify if my IRS 8606 has been processed?

To check the status of your IRS 8606, you can utilize the IRS's online tool 'Where's My Refund?' if it was filed with a Form 1040. You can also call the IRS directly for updates on your filing status, but be prepared to provide identification details for verification purposes.

What should I keep in mind regarding record retention for my IRS 8606?

You should maintain a copy of your IRS 8606 and any supporting documents for at least three years after the date you filed your tax return. This retention period ensures that you have all necessary documentation if questions arise or if you're subject to an audit by the IRS.

What should I know about e-signatures when filing IRS 8606?

When filing your IRS 8606 electronically, you should be aware that e-signatures are accepted if you are using a software program that supports electronic filing. Ensure you follow the appropriate steps indicated by the software to ensure compliance with IRS electronic filing standards.

How do I respond if I receive an IRS notice related to my IRS 8606?

If you receive a notice from the IRS concerning your IRS 8606, carefully read the document to understand the issue. Prepare any required documentation or explanations and respond within the timeframe provided in the notice to ensure that your concerns are addressed promptly.

See what our users say